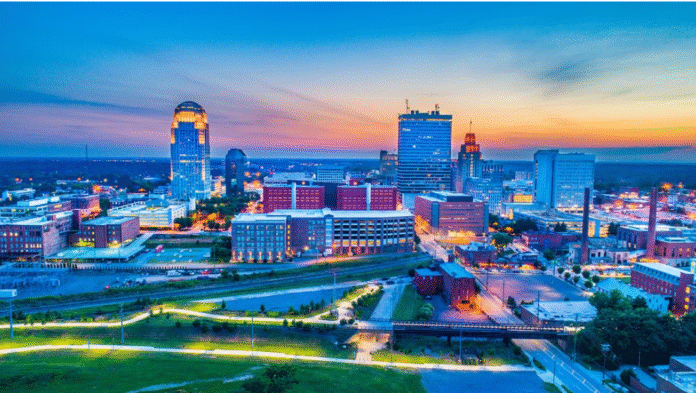

From right here in the Triad region of North Carolina, we represent our clients and their real estate requirements all over the Americas and world. Of course, our team also has deep, local business and real estate relationships as well as community and philanthropic ties. By and large, we have spent the majority of our lives in North Carolina, went to college here and have built our careers here. All of these factors give us a unique perspective on our region and how it relates to the broader world, how we’re similar, and how we differentiate ourselves.

For our multi-market tenant-rep team specifically, we are an extension of the client’s corporate real estate group, regardless of geography, and have the mandate to collaborate with Cushman & Wakefield local-market experts to achieve the best possible real estate transaction and outcome. At Cushman & Wakefield, our mantra is Better Never Settles, and that’s true whether we’re representing a local company for its office headquarters in Winston-Salem or a corporate client who needs manufacturing and distribution space in Latin America.

In many respects, the Triad’s office and industrial markets mirror others, especially our peers in the Sunbelt, and we have a couple of factors that set us apart as well. In tandem, our post-secondary education opportunities and skilled workforce are among the best in the U.S., whether that’s Wake Forest, UNC Greensboro, North Carolina A&T or any of our higher education institutions, community colleges or technical colleges.

Office & Industrial

The Triad office market is still working through the after-effects of the pandemic. Office-using employers continue to refine return-to-office and hybrid strategies with the overall goal of increasing utilization in an optimized workplace. While office redevelopment will take years to shake out, we certainly will see Triad properties reimagined for a use better suited to their surroundings, in both CBD and suburban settings.

Across the board, though, all of our corporate clients are working to get employees back to the office – whether that’s through stern mandates, enticements or a combination of both. As with most every market, the Triad’s newer, highly office properties are doing fine and now have low to manageable vacancy. In tandem with employers’ efforts to create a more inviting workplace, office investors and developers have invested heavily in creating amenities and activation, whether that’s through outdoor, rooftop and terrace spaces; food-and-beverage programs; or updated and refreshed lobbies, elevators and conference spaces. Increasingly, owner-investors and office tenants are creating spaces where workers want to be, and we’re seeing that uptick in our clients’ utilization metrics.

The Triad’s industrial market also reflects broader trends we’re seeing throughout the Americas. From 2021 to roughly mid 2023, the market took off with record-breaking development and absorption. Industrial markets then slowed mid ‘23, which left us with vacant speculative space and elevated vacancy, though occupancy was well within historic norms. At mid-year 2025 in the Triad, overall vacancy shrank 40 basis points in the second quarter, with zero new deliveries and 882,401 square feet of occupancy gains, even though overall net absorption is still negative.

Additionally, logistics and manufacturing operations locally and around the world are navigating the ever-shifting news on tariffs. Short-term, we’ve seen some companies move quickly over the past six months to get products into the U.S. Long-term, we’ve yet to see a major impact, though some decision making has slowed. Global enterprises tend to look years if not decades ahead and aren’t going to alter long-term strategic plans because of the shifting presence of tariffs in various countries.

Of course, the Triad has always been a great market for distribution and manufacturing, and our local and state economic development efforts are second to none, employing leading-edge recruitment and incentives strategies. Our workforce, available land and highly effective economic development teams play a major role in landing big wins like Toyota Battery Manufacturing North Carolina in Randolph County and its $13.9 billion investment and anticipated 5,100 direct new jobs. And then you have a surging aerospace cluster around Piedmont Triad International Airport, where Boom Supersonic last year opened its superfactory that’s anticipated to have a $32.3 billion impact with 2,400 new jobs over the next 20 years. Nearby, JetZero has announced plans for its first U.S. factory, which is anticipated to create 14,500 high-tech jobs, as well as relocation of its corporate headquarters.

While there is some softness in Triad office and industrial markets, that creates opportunity for Toyota, Boom and JetZero suppliers, among other logistics and manufacturing companies; the region’s growing firms and their workplace requirements; and entrepreneurial developers who may have a new vision for vintage properties. Overall, our region’s economy has tremendous momentum, driven by all the factors that make it unique, a handful of huge economic development wins and, of course, a highly desirable quality of life that’s the envy of some of our traffic-choked Sunbelt neighbors. That momentum will carry over not only through 2025 but long-term for a bright future for the Triad.