The BRICS and other countries are threatening the era of secure returns in the western world. The team at the Pictet research institute around Maria Vassalou examined how investors should invest now.

By Sarah-Christin Grossmann

In the brand’s electric SUV BYD thanks to Totwinkel assistants, jet carefree over the motorway to the weekend house, then photograph the mountain view with the Leica camera of the Xiaomi smartphone – Products from the Chinese companies BYD and Xiaomihave made the leap from Asia into everyday life in Europe and the USA.

Share of the smartphone manufacturer Xiaomi a real price rocket

The share of the smartphone manufacturer Xiaomi rose last year by an incredible 160 percent, while the security of the electric car manufacturer BYD rose by a good 30 percent. The yields on the Chinese share certificates could have easily financed private investors in Germany the next weekend vacation.

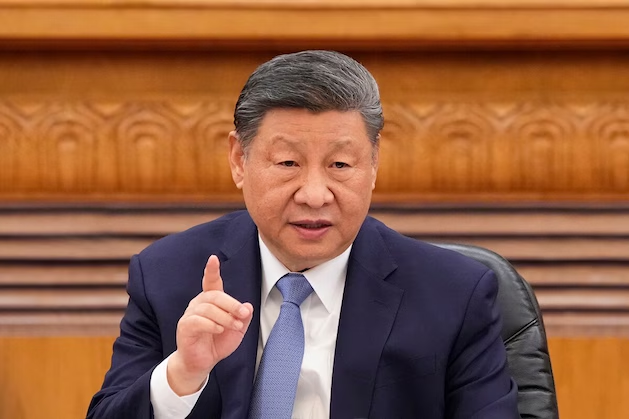

China strengthens together with its original allies

Brazil

India

Russia

South Africa

as well as new influential members like

Iran

and the United Arab Emirates

since the financial crisis in 2008 his coalition against the West, called BRICS +.

The geographical location of the BRICS countries

FOCUS MONEY, Adobe The geographical location of the BRIC countries

BRICS + countries with better growth opportunities than the industrialized countries

The economy of the BRICS + countries is expected to grow by an average of 3.8 percent over the next five years. The West with the G7 countries and the European Union (EU), on the other hand, is expected to grow by only 1.74 percent.

This emerges from the study by the American journalist and scientist Maria Vassalou from the Pictet Science Institute. Vassalou examined the global force measurement between the BRICS + countries and the USA.

„It is very important to rethink the playbook we are investing in “, the economist told FOCUS MONEY.

Donald Trump would like to take China off Tiktok

US President Donald Trump , who, according to his own statement, likes to watch Tiktok videos, is annoyed by the greater addiction potential of the Chinese algorithm. Because the Instagram algorithm of the American company Meta is considered less individual. Trump’s predecessor Joe Biden threatened to block the Tiktok app in the United States earlier this year if the Chinese parent company Bytedance did not sell its US business to US investors.

Companies from Europe and the USA lose market share

As the next step, Trump recently promised China tariff reductions in return for sales. The products of non-western countries are increasingly in demand in the West.

As a result, companies from the USA and Europe lose market share. The West is trying to defend itself against customs duties and prohibitions. In the case of Tiktok, however, so far without success.

According to Vassalou, the economic power of the BRICS + countries is based on

the possession of the latest technologies and rare earths

the world’s largest energy reserves

the control of important trade routes

high labor productivity

Each new member pays for superiority in a field.

BRICS + groups leader in electric cars

A brief overview of the investment opportunities in the individual areas: The BRICS + countries bring future technologies into the present. China’s electric cars have many advantages in entertainment and have autonomous functions while driving and parking.

China exported eleven million electric cars in 2024. The coalition of the emerging countries is also strong in sustainable technologies: China, India and South Africa produce more solar cells and wind turbines than the West.

The country alliance around China also dominates the world’s most sought-after export markets. The emerging countries export only approximately half of the value of the goods compared to the EU and G7 ($ 5.14 billion versus $ 11.2 billion). But China and Taiwan dominate the future-oriented semiconductor and electrical circuit market.

The critical goods are crucial, among other things, for the AI transformation and electrification of the transport sector.

Use rare investment opportunities

The ingredients for the production of the most innovative technologies are slumbering in China. The majority of the rare earths used in the West come from China. The People’s Republic holds 60 percent of the world’s rare earth shares and produces 90 percent of them.

Rare earths are required for AI chips, smartphones, as well as for military technology and the expansion of a green economy with wind turbines and for batteries from electric cars.

The BRICS + countries also dominate the aluminum market with around 75 percent market share and magnesium with over 95 percent. Both raw materials are required for the automotive industry and the production of packaging.

For example, mine companies that are attractive to investors were presented in issue 8/2024 by FOCUS MONEY.

Power plant for the depot

„The new wave of technologies for artificial intelligence requires a lot of energy “, says Pictet expert Maria Vassalou. The BRICS + countries have large oil reserves from Saudi Arabia, the United Emirates, Russia and Brazil.

China has the world’s largest capacity for wind and solar power plants with an estimated production volume of 1300 gigawatts. The high availability of energy enables the BRICS + countries to intensify their own research in AI technologies and is a diplomatic joker to the West. Oil producers or manufacturers of solar and wind power are a good chance for investors to earn a living. In 2023 alone, the export volume of the BRICS + countries was $ 4,686 billion.

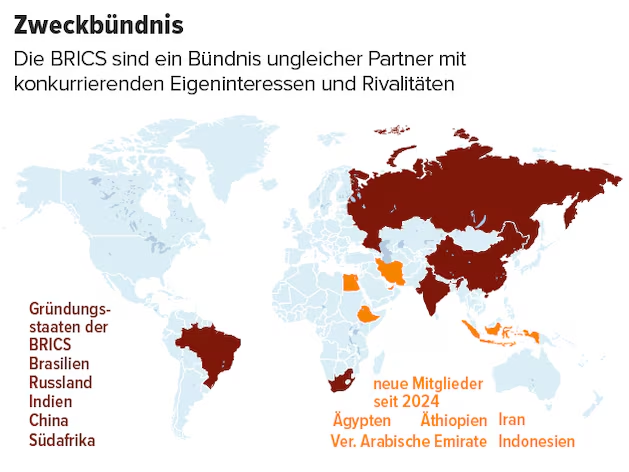

China Telecom: profiteer of digitization

The Chinese group China Telecom provides Chinese smartphones, houses and companies with the Internet. The company also sells its data centers and clouds to industry. The business model benefits from China’s progressive digitization and the broad expansion of the 5G infrastructure.

Investors are profiteers of a solid return of a good five percent this year and next and buy at a fair price, as the P / E ratio of 13.9 indicates

Dateen on China Telecom.

FOCUS MONEY, Bloomberg Dateen on China Telecom.

Vale: iron ore and nickel

The mining group with its operational headquarters in Brazil is one of the largest producers of iron ore and nickel. Steel is extracted from iron ore, crucial for the construction of railroad tracks, houses and wind power rotors. Nickel is used in electric car batteries.

The share promises a return of around eight percent this year and next. Almost 90 percent of the shares are free to trade on the stock exchange, which reduces the risk of political influence

Key data on Vale.

FOCUS MONEY; Bloomberg Key data on Vale.

BRICS + is a power at sea

The sea route is most important for trade: 90 percent of the exports and imports of the BRICS countries are shipped. Here, too, the BRICS countries have a competitive advantage over the West because they control four of the six maritime bottlenecks. They also control the Indian Ocean and the Silk Road.

Qingdao Free Trade Zone Container Trade

CFOTO / Future Publishing via Gett Chinese container ship.

The last major competitive advantage of the emerging countries is the more productive population. 14.72 percent of retired people live in the BRICS + countries, and 32.85 percent in the EU and the G7 countries are twice as many.

„Not to forget that many of the BRICS + countries have a highly educated population “, says Vassalou. Many specialists were trained at top universities in the USA and in Europe. They would have transferred this knowledge to their home country. Investors can therefore achieve decent returns with stocks from large IT service providers from China and India.

Invest dynamically

Despite the promising factors of the BRICS + countries, an investment involves some risks. The showdown between the western world and the emerging powers has not yet been decided. Competition between the individual BRICS + countries could also hamper common economic growth.

The state often holds a large part of the shares in share certificates from BRICS + countries. This is the case with the world’s largest and listed oil company Saudi Aramco. The monarchs of Saudi Arabia own 81 percent of the shares and determine the export volume of oil. Depending on the decision to increase or reduce the amount of oil required, the share price could decrease or rise. This cannot be predicted for investors.

BRICS + countries often ruled autocratically

BRICS + countries are often also governed autocratically. A possible change of power in the future can change the investment in individual technology trends and thus reduce the country’s dominance in this market. „Investments should be managed more dynamically “, advises Vassalou.

Nevertheless, investors should not withdraw all of their assets from western markets. The economic performance of the G7 countries and the EU is significantly seven times greater per capita than in the BRICS + countries. The main problem, according to the Pictet study, is that the BRICS + countries fail in their own currency. Funding is therefore parked on the US bond market, which enables the country to finance large investments with new debt. The US dollar comprises 44 percent of the global currency market; the Chinese renminbi only 3.5 percent.

Donald Trump’s punitive tariffs burden China

The Customs duties from the West hit China as economic driver of the BRICS countries and export king also hard. Until a new balance is established on the market, price developments remain volatile and risky.

Vassalou therefore recommends that the budget be divided into markets in the USA and the BRICS + countries. A „next so “ would be risky for the depot. Investors should invest „thematically “, emphasizes Vassalou. Regardless of the form of government and culture, energy, semiconductors, rare earths and IT services form a good starting point for a thematic investment that can withstand the global showdown.