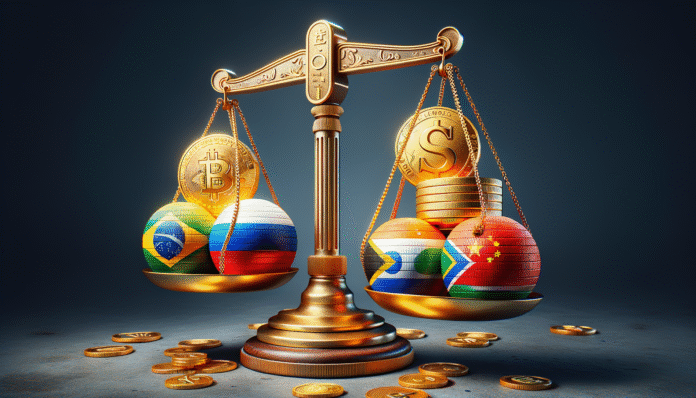

Imagine a world where the U.S. dollar, long the unchallenged king of global finance, faces a serious rival. As of January 11, 2026, that world is becoming a reality with the emergence of a BRICS-backed currency, fortified by a staggering 40% gold reserve. This isn’t just a ripple in the financial pond it’s a potential tsunami that could reshape everything from international trade to the cryptocurrency market, where Bitcoin is currently trading at $90,645. For investors, traders, and anyone with a stake in the global economy, this development could redefine how we think about money, value, and power in the years ahead. What does this mean for your portfolio, and could this be the catalyst that pushes digital assets like Bitcoin and Ethereum into uncharted territory?

The BRICS alliance comprising Brazil, Russia, India, China, and South Africa has introduced this currency with a clear goal: to challenge the dollar’s hegemony and create a more balanced financial order. With gold as a cornerstone of its value proposition, this new currency is positioned as a stable alternative in a world of fiat volatility. But what does this mean for cryptocurrencies, often hailed as the ultimate hedge against traditional financial systems? Stick with me as we unpack this seismic shift, explore its implications for markets, and arm you with the insights you need to navigate what’s coming next. Curious about how this could impact Bitcoin’s trajectory? Get AI analysis for Bitcoin and stay ahead of the curve.

Market Analysis and Key Developments

The financial world is buzzing with the news of the BRICS currency, and for good reason. As of January 2026, this gold-backed contender is not just a theoretical concept but a tangible force, with a 40% gold reserve providing a foundation that many fiat currencies lack. According to Bloomberg reports, this move is a deliberate strategy by BRICS nations to reduce reliance on the U.S. dollar in international trade, a dominance that has persisted for decades. The timing couldn’t be more critical, as global economic uncertainties and geopolitical tensions continue to mount.

Bitcoin, often dubbed “digital gold,” has seen a modest uptick of 0.26% to $90,645, reflecting cautious optimism among investors. Ethereum, meanwhile, is trading at $3,093.32 with a 0.44% increase, per CoinGecko data, suggesting that altcoins are also feeling the ripple effects of this macroeconomic shift. But the market sentiment isn’t all rosy the Fear & Greed Index sits at a wary 29, indicating that fear dominates as investors grapple with what this new currency could mean for traditional and digital assets alike.

What’s driving this uncertainty? Analysts point to the potential for the BRICS currency to alter trade dynamics, especially in commodity markets like oil and gold, which are often dollar-denominated. If BRICS nations and their partners begin transacting in this new currency, the dollar’s influence could wane, sending shockwaves through every corner of finance. This isn’t just about fiat it’s about how cryptocurrencies might either thrive as decentralized alternatives or face new competition from a gold-backed rival.

BRICS Take Charge: 40% Gold Unit Currency Starts Challenging Dollar

Imagine a world where the U.S. dollar, long the unchallenged king of global finance, faces a serious rival. As of January 11, 2026, that world is becoming a reality with the emergence of a BRICS-backed currency, fortified by a staggering 40% gold reserve. This isn’t just a ripple in the financial pond, it’s a potential tsunami that could reshape everything from international trade to the cryptocurrency market, where Bitcoin is currently trading at $90,645. For investors, traders, and anyone with a stake in the global economy, this development could redefine how we think about money, value, and power in the years ahead. What does this mean for your portfolio, and could this be the catalyst that pushes digital assets like Bitcoin and Ethereum into uncharted territory?

The BRICS alliance comprising Brazil, Russia, India, China, and South Africa has introduced this currency with a clear goal: to challenge the dollar’s hegemony and create a more balanced financial order. With gold as a cornerstone of its value proposition, this new currency is positioned as a stable alternative in a world of fiat volatility. But what does this mean for cryptocurrencies, often hailed as the ultimate hedge against traditional financial systems? Stick with me as we unpack this seismic shift, explore its implications for markets, and arm you with the insights you need to navigate what’s coming next. Curious about how this could impact Bitcoin’s trajectory? Get AI analysis for Bitcoin and stay ahead of the curve.

Market Analysis and Key Developments

The financial world is buzzing with the news of the BRICS currency, and for good reason. As of January 2026, this gold-backed contender is not just a theoretical concept but a tangible force, with a 40% gold reserve providing a foundation that many fiat currencies lack. According to Bloomberg reports, this move is a deliberate strategy by BRICS nations to reduce reliance on the U.S. dollar in international trade, a dominance that has persisted for decades. The timing couldn’t be more critical, as global economic uncertainties and geopolitical tensions continue to mount.

Bitcoin, often dubbed “digital gold,” has seen a modest uptick of 0.26% to $90,645, reflecting cautious optimism among investors. Ethereum, meanwhile, is trading at $3,093.32 with a 0.44% increase, per CoinGecko data, suggesting that altcoins are also feeling the ripple effects of this macroeconomic shift. But the market sentiment isn’t all rosy the Fear & Greed Index sits at a wary 29, indicating that fear dominates as investors grapple with what this new currency could mean for traditional and digital assets alike.

What’s driving this uncertainty? Analysts point to the potential for the BRICS currency to alter trade dynamics, especially in commodity markets like oil and gold, which are often dollar-denominated. If BRICS nations and their partners begin transacting in this new currency, the dollar’s influence could wane, sending shockwaves through every corner of finance. This isn’t just about fiat, it’s about how cryptocurrencies might either thrive as decentralized alternatives or face new competition from a gold-backed rival.

What This Means for Investors

Let’s cut to the chase: the BRICS currency could be a game-changer for your investment strategy. If it gains traction, the U.S. dollar’s purchasing power could weaken, potentially driving inflation and prompting central banks to hike interest rates. For crypto investors, this presents a double-edged sword. On one hand, Bitcoin and Ethereum could see increased demand as hedges against fiat devaluation after all, their decentralized nature makes them immune to government manipulation.

On the flip side, a stable, gold-backed currency might siphon off some of the appeal of cryptocurrencies as safe havens. Why invest in a volatile asset like Bitcoin if a new fiat alternative offers stability with gold’s backing? This is a question many are asking, and the answer isn’t clear-cut. For now, diversifying across asset classes holding some crypto, some traditional investments, and keeping an eye on emerging opportunities seems prudent.